Bank of Mexico Gov. Agustín Carstens sat down on Friday, Aug.

26, 2016 with Wall Street Journal reporters Jon Hilsenrath and

Harriet Torry on the sidelines of the Kansas City Fed's monetary

policy research symposium in Jackson Hole, Wyo.

He discussed Mexico's monetary policy and public sector debt, as

well as the debate over negative interest rates.

Here is a transcript of the interview, lightly edited for length

and clarity.

MR. CARSTENS: We are all very into our own problems, and I think

that this year, the topic is very thought-provoking. And I think

we're all sort of reflecting a lot of -- on the toolbox of monetary

policy. (Laughs.)

MS. TORRY: Well, one of the things that we've both been

interested in talking about is negative rates. Of course, this

isn't something that is directly affecting you at the moment.

MR. CARSTENS: Yeah.

MS. TORRY: What are your thoughts on negative rates, and how

they -- how [they] impact emerging markets?

MR. CARSTENS: Well, I mean, I think something that has been made

clear during this -- today's session, and even during -- it was an

important part of the message of [Federal Reserve] Chair [Janet]

Yellen, was that there are equivalent ways -- (chuckles) -- to get

the same, the same result. And you know, (inaudible) negative rates

don't seem to be a good idea.

I think that the real relevant thing is that today we're

discussing, in a way, pretty much the boundaries of monetary policy

-- you know, how far monetary policy can go in terms of promoting

economic growth, in terms of returning to a much -- to a normal

performance of inflation. And, it has -- it was made clear by Chair

Yellen's speech that we didn't have the right toolbox and that we

have been in the need to -- I mean, the central banking community,

but in particular advanced economies' central banks have been

facing the need to -- improvise as events unfold. And I think that

that has a lot of value added, I think, that to have the benefit of

hindsight and to evaluate, you know, how far can we go with

monetary policy and in particular what is the toolbox that is

necessary to face even some scenarios that were unthinkable many

years ago.

JON HILSENRATH: Coming back to the point about negative rates,

what's your assessment, to the extent that you've looked at this,

of the costs and benefits of negative rates?

MR. CARSTENS: Well, I mean, I still -- my colleagues, central

bank colleagues, have expressed convincing arguments about the net

benefits of those measures. I mean, certainly it has been

recognized that in some cases, it might affect commercial banks. It

might weaken their strength and it can weaken creation. But if you

add up all together, we're still not at the point where we have net

costs. I sort of -- I mean, I agree with that.

And I also felt that there was a little bit of a pushback in the

audience today when extreme negative rates were suggested.

(Laughs.)

So, I mean, I think that so far it has worked well, but at the

same time I think that prudence is called for as we move

forward.

MR. HILSENRATH: But you say it could -- it could hurt commercial

bank profits and thus their willingness to lend?

MR. CARSTENS: And you know, commercial banks, I mean, their --

yes, their capacity to lend, yes.

MS. TORRY: I wanted to ask your views on Mexico's efforts to

contain its growing public-sector debt. It is 50 % of [gross

domestic product] this year, and Moody's and Standard & Poor's

have reacted. What are your views on that?

MR. CARSTENS: Well, of course it is important. Just if you --

pretty much the day before Moody's made this ruling, the Ministry

of Finance came out with a very detailed analysis on the public

finances, offering far more information, putting into perspective

the dynamics of public finances in Mexico.

And I see a real desire of the Ministry of Finance to contain, I

would say, the growth of public debt over GDP and in a way make

this not to be an issue as we move forward.

Certainly, there are some dynamics that are under way that have

been affecting the public finances. Some of them have been, for

example, the growth in pensions. And at the same time, also, the

fall in the price of oil has been very, very, very important. There

has been an adjustment. For example, traditionally, oil-related

income would finance more than 30 % of expenditures, and lately it

has been only 13 %. So that is -- that is a very significant

shock.

But it is very, very clear that we need to contain the growth of

debt over GDP. And in the coming weeks, on the 8th of September,

the federal government has to present its fiscal plan for next

year. And my sense is that they will be reassuring in this

regard.

MS. TORRY: OK. What is the level of risk you see on how rising

debt is contributing to the weakness of the peso?

MR. CARSTENS: Well, I mean, I -- to this -- at this stage, I

don't -- I don't sense that that has been a major issue. I think it

is -- for some time already -- for some time already, the Mexican

government has been taking action, and in a way this was a

surprising call by Moody's, no?

At the -- at the beginning of the year, we had some issues

related to [state oil company] Pemex and decisive actions were

taken. This year, the government reduced its expenditure goals in

February, and then also when the Brexit news came out.

So I think that, fiscally, the government has been taking a very

precautionary -- has had a precautionary attitude this year. It

also has made a very important commitment that is out there, and

that is that for the first time since 2009, the Mexican government

will have a primary fiscal surplus.

So probably, yes, a little bit what has affected the ratio is

that growth has been slower than anticipated, but that also has

been the fact that we have seen in terms of global growth. And what

has been advocated in fora like the [International Monetary Fund],

the G-20 and so on is that you have backed structural reforms and

so on, and Mexico has done that.

So I think that sometime soon, I expect that more growth will be

seen as a result of -- as a result of the reforms. Also, my sense

is that there are expectations for stronger growth in the U.S., and

that should help Mexico.

MR. HILSENRAT H: There's also expectations, as Yellen said

today, that the Fed is going to raise rates again. Given the

slower-than-expected growth in Mexico, the impacts of Fed rate

increases on the currency, are you at all -- or how well-positioned

is the Mexican economy to rate increases here?

MR. CARSTENS: Well, I mean, this is not a new phenomenon.

(Laughs.) This is -- this is something that has been on the table

for quite some time. In a way, it precisely shows that the U.S.

economy is recovering, the labor market is showing better

performance, and so on. And we have mentioned in our -- Banco de

Mexico has mentioned in its monetary policy communiqués already for

quite some time that one of our most important variables that we

will follow in making our decision is the monetary -- the relative

monetary policy stance of Mexico vis-à-vis the U.S. So we are

prepared, I would say, to react to the situation if we see that the

action of the Fed's affects inflation, and the transmission

mechanism probably would be the exchange rate.

So if the action that the Fed might take, it has an impact on

expected inflation, we will have to tighten monetary policy. So the

interest rate differential versus the U.S. is very important, and

certainly plays a very important role as we decide our own monetary

policy action.

MR. HILSENRATH: So when we've talked about this in the past, it

sounded like you were prepared to move when the Fed moved. Is this

now a case where you're prepared to see the Fed move and then see

how exchange rates respond before making a decision? Or are you

committed to going one for one with any Fed action?

MR. CARSTENS: Well, I mean, this is one more of the determinants

of inflation. If you see this year, we have had two hikes in

addition to what the Fed did. The Fed moved in December of last

year. We moved then in parallel. Then we tightened 50 basis -- then

we tightened 50 basis points in February and we tightened an

additional 50 basis points in the summer, no?

MR. CARSTENS: So, in a way, I mean, that shows that we are not

going to wait for Fed actions. Fed actions might trigger some

reaction from our side, but we will also respond to other

determinants of inflation. It might also be that what we have been

seeing in terms of the developments of the exchange rate shows some

anticipation of the Fed action. So, you know, if the Fed action is

sort of anticipated and is reflected in the market and we see that

that doesn't have consequences on inflationary expectations, we

might not act. But if that's not the case, we are prepared to

act.

MR. HILSENRATH: Right. So I just want to be sure I understand

that. It sounds like you're saying that, because you've already

moved pretty aggressively two times this year, it might not be the

case that you have to act again, even if the Fed does -- that it

depends on market response.

MR. CARSTENS: Yeah, yeah. But we have underlined that we will be

watching it very carefully. (Laughs.)

(END) Dow Jones Newswires

August 27, 2016 15:20 ET (19:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

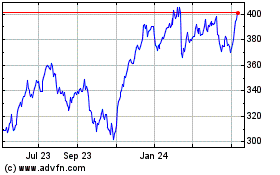

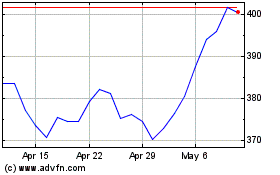

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024